Getting into your first home has to be one of the most exciting milestones in life. On the flip side, it can be a little stressful.

You’ve got to establish where you want to live, the type of property – house or unit, whether to buy an existing property or build new, how much you can afford to borrow, whether you qualify for first home buyer grants and how much?

Green Team home finance brokers work with first homebuyers week in and week out and know what it takes to guide you through the process and make buying your first home much easier.

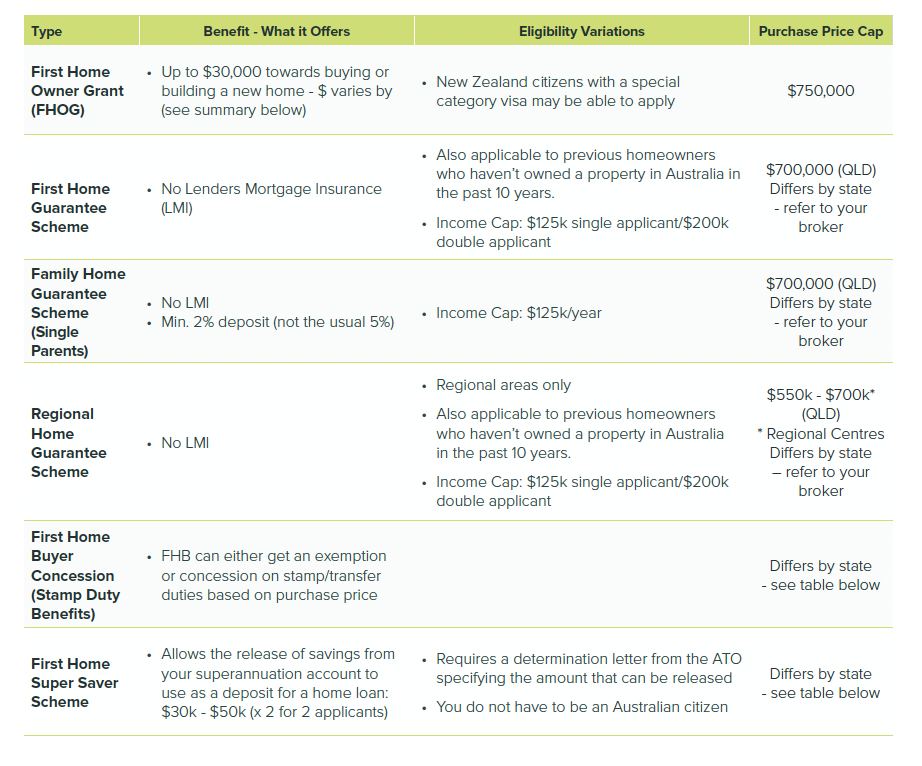

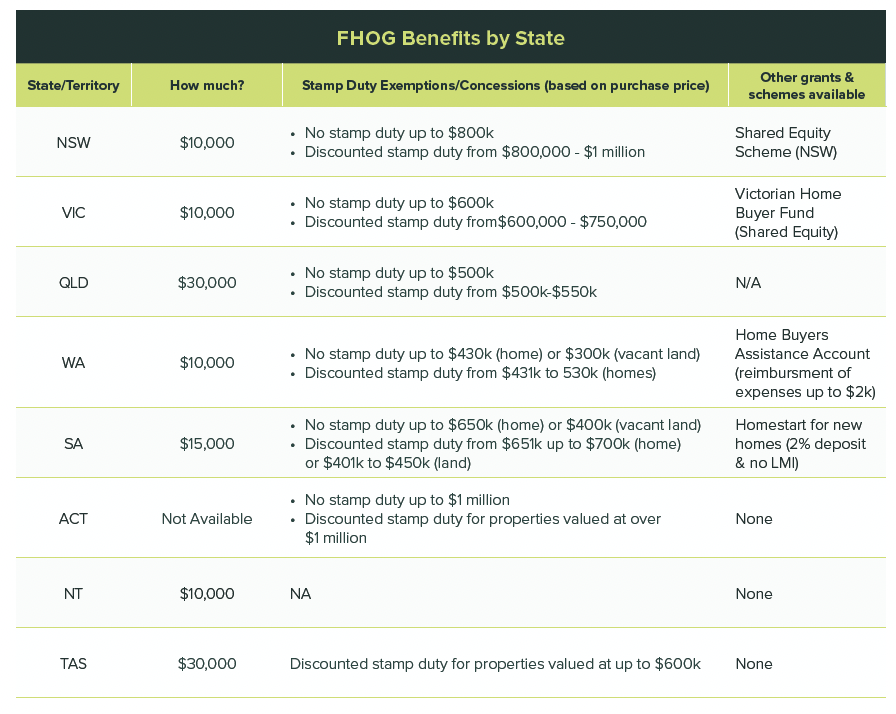

Additionally, there are various government schemes available to help first-home buyers (FHB) purchase or build a home, so you may have more of a helping hand than you think.

This is a guide only as at the time of publishing and details change regularly so remember, your Green Team finance broker will be in the best position to provide a complete overview of the combination of benefits available to you today.

Eligibility may differ by scheme but generally, to be classified as a First Home Buyer (FHB) you must:

In addition to helping you establish FHB benefits available to you, your Green team finance broker will:

Arranging your finance first may give you an advantage over other buyers when the time comes to make an offer on a property.

1. Know your actual borrowing capacity so you can narrow your property search and find the home you can afford. Online calculators are great but they are a guide only. Your finance broker will be in the best position to provide amore accurate overview of your borrowing limits from a range of lenders.

2. Take advantage of a shifting market.

3. Bid at auction with confidence, arriving prepared with finance ready.

4. Be a serious buyer to sellers. A buyer with a pre-approved loan is much more appealing than someone who has yet to arrange their finances.

5. Pre-approval is valid for up to three months. If you don’t find your dream home during that time, re-applying is simple with your Green Team finance broker.

6. It costs you nothing to get pre-approved.

For a complete guide to how much you can borrow, loan options, first home buyer benefits available to you and quite simply, how to get a better finance deal, click below to request a call back or reach out to your Green Team finance broker direct.

Published: 12.3.24

THE FINEPRINT: The information provided on this site is on the understanding that it is for illustrative and discussion purposes only. While all care and attention are taken in its preparation any party seeking to rely on its content or otherwise should make their own enquiries and research to ensure its relevance to your specific personal and business requirements and circumstances.

Green Finance Group Pty Ltd ACN 145 035 221 is authorised under LMG Broker Services Pty Ltd ACN 632 405 504 Australian Credit Licence 517192.