6 March 2024

As a general rule of thumb, if it’s been at least two years since you took out your home loan, it might be a good idea to review refinancing options.

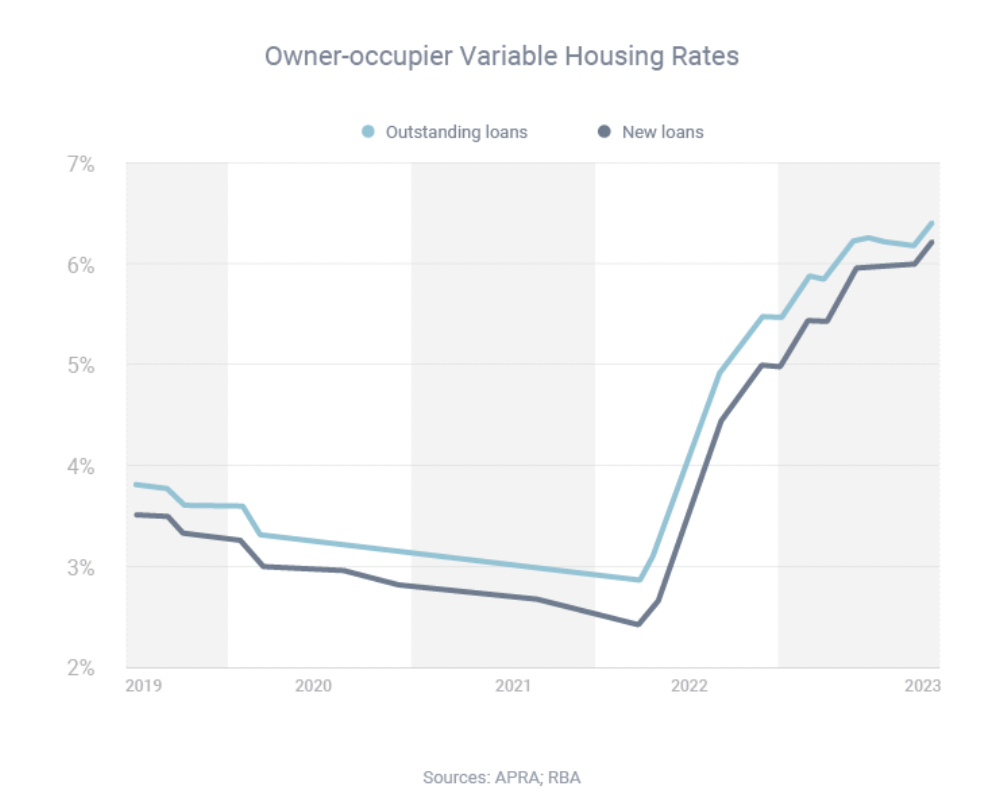

That’s because lenders, which want to win your business, often charge lower interest rates to attract new borrowers, rather than their existing customers.

Recent Reserve Bank data for owner-occupiers with variable-rate home loans found borrowers taking out new loans paid 0.16 percentage points in interest less than those with existing loans. Reducing your mortgage rate by just that amount could potentially save you many thousands of dollars over the life of your remaining loan term. And, if your finance broker got you a larger rate cut, your savings would be even more impressive.

You should also think about refinancing if your personal or financial situation has changed, for example if:

Reach out if you’re unsure how refinancing works, we can review the pros and cons that would apply to your personal situation.

THE FINEPRINT: The information provided on this site is on the understanding that it is for illustrative and discussion purposes only. While all care and attention are taken in its preparation any party seeking to rely on its content or otherwise should make their own enquiries and research to ensure its relevance to your specific personal and business requirements and circumstances.

Green Finance Group Pty Ltd ACN 145 035 221 is authorised under LMG Broker Services Pty Ltd ACN 632 405 504 Australian Credit Licence 517192.

“My background in banking combined with the flexibility of being an independent finance broker means I can offer my clients the best of both worlds – I know bank process and policy inside out and I can provide a real choice of loans from a big range of banks, not just one.”

Whether you are a first homebuyer, an experienced property investor, wishing to renovate or upgrade, or you simply want to save money on your existing mortgage, Nathan has the lending knowledge and experience to help you find savings with a better home, car or personal loan.

My career in finance began in the early 2000s with NAB, one of Australia’s Top 5 banks, where I worked for over a decade securing funding and everyday banking solutions for both private and business clients.